Gold Prices Hit Record High Amid Global Uncertainty!

Gold continues to be a top investment choice in India. With inflation and economic concerns, gold prices have surged over 20% in the past year.

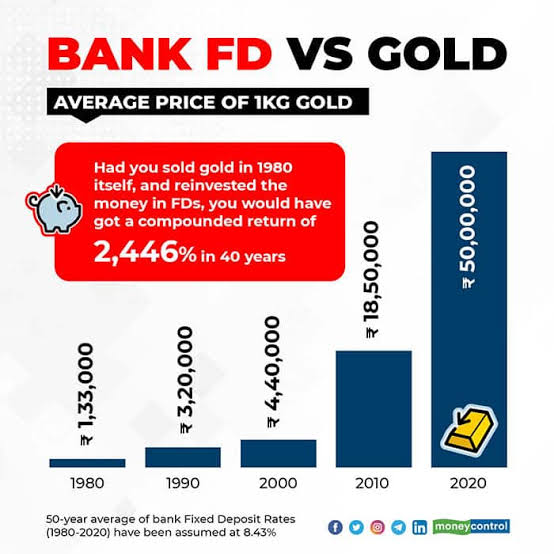

📊 Gold Price History

- 📌 2000: ₹4,400 per 10 grams

- 📌 2010: ₹18,500 per 10 grams

- 📌 2020: ₹50,000 per 10 grams

- 📌 2024: ₹54,000 per 10 grams

- 📌 2025 (Feb): ₹65,000 per 10 grams

💡 Experts predict that gold could cross ₹70,000 per 10 grams by the end of 2025 if global uncertainties continue.

🚀 New Ways to Invest in Gold

- ✔ Sovereign Gold Bonds (SGBs): Govt-backed, 2.5% annual interest.

- ✔ Gold ETFs: Trade like stocks, no storage issues.

- ✔ Digital Gold: Buy/sell gold online from ₹1.

💰 Fixed Deposit Rates Reach 5-Year High!

Due to rising interest rates, banks are now offering the highest FD rates in five years.

📊 Fixed Deposit Interest Rate Comparison (2025)

| Bank | Interest Rate (5 Years) |

|---|---|

| SBI | 7.25% |

| HDFC | 7.40% |

| ICICI | 7.50% |

💬 Banking Expert View: “For risk-free, guaranteed returns, FDs are a great option. But they don’t beat inflation like gold.”

📢 New FD Features in 2025

- ✔ Tax-Free FDs: Save tax under Section 80C.

- ✔ Senior Citizen FDs: Special rates up to 8.2%.

- ✔ Monthly Interest Payouts: Regular income from FDs.

🔎 Gold vs FD: Which One Should You Choose?

| Feature | Gold 🏅 | Fixed Deposit 💰 |

|---|---|---|

| Risk Level | Low (Long-term) | Very Low |

| Liquidity | High | Medium |

| Returns (Last 5 Years) | 12-15% per year | 6-8% per year |

| Tax Benefits | Yes (SGBs) | Yes (Tax- Saving FDs) |

| Best For | Inflation Hedge | Guaranteed Returns |

Image source: Moneycontrol.com

Image source: Moneycontrol.com

📢 Final Verdict: What Should You Invest In?

- ✔ Choose Gold if you want higher returns and a long-term inflation hedge.

- ✔ Choose FD if you need guaranteed income and zero risk.

- ✔ Best Strategy? 50% in Gold + 50% in FD for a balanced portfolio.

📢 Best Strategy? 50% in Gold + 50% in FD for a Balanced Portfolio

Investing in both gold and fixed deposits can help balance risk and reward. Gold serves as a hedge against inflation, while FDs provide stability and guaranteed returns. By splitting your investments, you can benefit from growth during economic uncertainty while ensuring a secure backup with fixed deposits.

Why Should You Invest in Gold?

Gold has been a trusted store of value for centuries, and its price generally rises during global crises. Unlike stocks or cryptocurrencies, gold is not as volatile, making it a safe-haven investment. Some key reasons to invest in gold include:

- Protection Against Inflation – When inflation rises, gold prices usually increase.

- Liquidity – Gold is easy to buy and sell, especially digital gold.

- Diverse Investment Options – Choose from SGBs, ETFs, digital gold, or physical gold.

Why Should You Invest in Fixed Deposits?

Fixed deposits offer capital protection and stable returns, making them ideal for those who want risk-free earnings. Some advantages of investing in FDs include:

- Guaranteed Returns – Unlike stocks or mutual funds, FD returns are fixed.

- Tax Benefits – Tax-saving FDs allow deductions under Section 80C of the Income Tax Act.

- Best for Retirement Planning – Senior citizens get higher interest rates on FDs.

Final Thoughts

Both gold and fixed deposits have their own benefits. A diversified approach ensures you maximize returns while minimizing risks. If you are a long-term investor, gold can provide higher appreciation, while FDs offer stability and security.

🔴 What’s your investment plan? Let us know in the comments!

🔴 What’s Your Pick? Comment Below!

Stay tuned to ShortNews24 for more financial insights!